You’re well aware that the price of health coverage is increasing. You’re probably even aware that the price has been rising unrelentingly for decades. What you may not realize is that, despite the fact that you’re paying more and more every year, you are also increasingly in the crosshairs of those looking for someone to blame. And if you don’t do something about it now, it’s only going to get worse.

Health Care Prices Are Out of Control

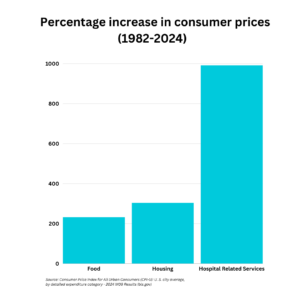

Inflation is real, and families and businesses alike are feeling the squeeze. But when it comes to skyrocketing prices nothing — not food, not housing — nothing compares to the price of health care.

Inflation is real, and families and businesses alike are feeling the squeeze. But when it comes to skyrocketing prices nothing — not food, not housing — nothing compares to the price of health care.

Since 1982, when the U.S. Bureau of Labor Statistics began recording monthly CPI price changes, the price of medical products (including prescription drugs and over-the-counter medications) has increased by 316%. The price of medical services has increased by 515%. And hospital prices have increased by a staggering 992%.

Employers Bear the Brunt of Skyrocketing Health Care Prices

A recent report by CBS News sums up the situation well:

More working-age Americans receive health insurance through their employers than any other source, with about 60% — or 164.7 million people — covered by their workplaces, according to KFF.

Companies, which typically pick up the bulk of their employees’ health insurance costs, are likely to spend more than $18,000 on average to insure each worker in 2026, Mercer told CBS News. Workers typically shoulder between 16% to 25% of the total, depending on whether they are receiving single or family coverage, according to KFF’s 2024 employer health benefits survey.

But Employers Are Increasingly Sharing the Blame

Despite paying more and more each year to provide employees health coverage, businesses are increasingly being blamed for the rise in expenses.

The most egregious example of this is the recent NPR story we told you about, but that’s the canary in the coal mine.

Because most people are employees and not employers, news reporting focuses on the increased price paid by the employee. And since that expense is withheld from paychecks, it can all too easily appear like it’s the employer responsible for the rate increase.

A story published by NBC News says, “Some employers could raise premiums next year,” though it’s not the employer raising the premium. Or take this opening paragraph from a report in USA Today:

Working-age Americans who get health insurance through their jobs will soon confront an unpleasant fact – the largest health insurance rate increases since 2010.

That, too, makes it sound like it’s the employer who’s raising prices.

So, what’s an employer to do?

Employers Must Take Control

If you want to lower your health care expenses AND avoid taking the blame for higher health care prices, you must get your health care data and put it to use.

If you’re a member of Texas Employers for Affordable Health Care get free access to the Texas Employer Health Care Data Field Guide developed by health care benefit expert Chris Deacon. This guide tells you how to get your health care data and how to put it to use to improve the price and value of your health benefit plan.

You Don’t Really Have a Choice

As employers, you don’t really have a choice. If you do nothing and continue to pay more every year for health benefits, you will not only watch your employees and your business suffer, you risk facing legal action for breach of fiduciary duty to your employees.

You Don’t Have To Do It Alone

Organizations like Texas Employers for Affordable Health Care, the Texas Business Group on Health, and the National Alliance of Healthcare Purchaser Coalitions are working with state and federal lawmakers to identify common sense solutions for improving the value of health benefit plans.